If you run a website, there is a high likelihood that you are also in the business of monetizing that website. The most common way to monetize a website is to join an affiliate network, which gives you access to advertisers that you can post on your site. This is an easy way to get access to a bunch of different advertisers, and most networks make it easy to ad the necessary code to your website. Types of Affiliate Advertising Programs Affiliate networks or programs have several different ways that they pay: - Pay-per-click: As it sounds, you are paid every time someone clicks on a link or ad. The most popular pay-per-click affiliate network is Google Adsense. - Pay-per-lead: This option is for advertisers that are … [Read more...]

Becoming a One Income Family

What we're currently working on in our family is living off of one income. Yes, there's only two of us, so it's not as hard as if we had a family with children, but it is still not the easiest. We're working on paying off student loans and then our mortgage, and would like them all gone within the next couple of years. And this is why we are working on living off of less than 50% of our incomes (this includes our expenses and our minimum monthly mortgage payment of $970 and minimum student loans of around $300 per month). The rest of our monthly income is getting thrown like crazy towards our debt as extra debt payments. Yes, we could continue living the way that we used to and pay off our debt slowly, but we hardly notice a difference … [Read more...]

Can’t Keep Up? 5 Ways To Simplify Your Multiple Income Streams

Developing multiple income streams means balancing different tasks all of the time. If you're not prepared (mentally, organizationally, etc.), it can quickly get overwhelming. In fact, I felt myself overwhelmed several times over the past year (just read my income stream report from November 2011). However, I've found several ways to cope and push through the hard times, and I want to share them with you! Here are five ways that you can simplify your multiple income streams to make them work for you, and not have it be the other way around! 1. Stay Organized The first step is staying organized. This can be a real challenge as you build multiple site, try to invest, or even own real estate. I've found this to be a big issue as … [Read more...]

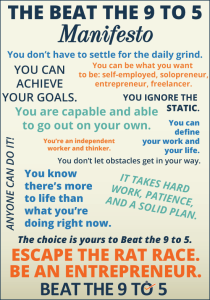

Should You Start Your Own Side Hustle?

What's a fast way to jump start your savings, increase your income and pay down debt faster? Get a side hustle! I am a big proponent of increasing your income, instead of finding additional ways to cut back. Mainly because there are only so many ways that you can cut back, but the amount that you can increase your income is endless. Side hustles can also increase your skills at your current position. Talking to others in your side hustle area can help you understand certain terms or common knowledge. Also, maybe your dream is to eventually make your side hustle your full time job. Having it as a side hustle first can help you decide if this is what you can do, if it's sustainable and so on. I have multiple side income, with online income … [Read more...]

How To Invest To Generate a Passive Income

Generating a passive income is hard to do, but there are many ways to do it. I will cover the most common and basic ones here. It is important to note that most income is not truly passive in the sense that no work was required. However, in my examples below, you will see how the income is now passive since the work was done prior to the income being made. Passive Investment Income The first major way individuals generate passive income is through investments. This can be done because many investments distribute gains in the form of dividends or distributions. These dividends and distributions are income, and many people are able to live off of them. A common strategy is to put together a portfolio of high dividend paying stocks. In … [Read more...]

How To Boost Your Salary – Without Asking!

I know the title may sound like a misnomer, but there is a way you can get a raise without asking your boss, talking to HR, or really doing anything - it is taking all the vacation days you're entitled to. The average American worker leaves almost 7 days of vacation unused each year. Not only could that go to waste (some companies don't allow you to carry vacation over), but you are not taking advantage of a huge part of your total compensation. Vacation is Compensation If you are an employee, vacation is factored into your compensation plan. If you don't take all of your vacation, you are basically leaving money on the table. Let's break it down. I assume that you get two weeks of vacation total, but I will run three scenarios … [Read more...]