As I discussed last month, I will be purchasing a new home and renting out my existing home. This is a big change, but one of the biggest motivating factors is how cheap interest rates are right now. I personally believe they are at historic lows that I may not see again in my lifetime, so I want to take advantage of that. However, over the course of the last two weeks, I’ve gotten a crash course in shopping for a home loan, and I want to share with you what I’ve learned so that you can make an informed decision when you go to buy a home.

As I discussed last month, I will be purchasing a new home and renting out my existing home. This is a big change, but one of the biggest motivating factors is how cheap interest rates are right now. I personally believe they are at historic lows that I may not see again in my lifetime, so I want to take advantage of that. However, over the course of the last two weeks, I’ve gotten a crash course in shopping for a home loan, and I want to share with you what I’ve learned so that you can make an informed decision when you go to buy a home.

So, here is my ultimate guide to shopping for a home loan.

Knowing the Terms

One of the biggest challenges of shopping for a loan is dealing with all the different terms that lenders will throw out at you. It is important to remember that most of the people you will talk to in the process of getting a loan are sales people. As such, it is important that you compare more than just the interest rate. To do that, you need to be aware of what things are called. Here is a quick breakdown:

Interest Rate: This is the interest rate you pay on the loan. It can be either fixed or variable. A fixed rate is traditionally sold as either a 30, 20, or 15 year fixed rate loan. A variable rate loan is traditionally sold as an “Adjustable Rate” loan, that is fixed for a period of time (3, 5, or 10 years), and then adjusts at set intervals (usually annually).

Points: Points are essentially “prepaid interest” to buy down the interest rate on your loan. Points can work in reverse as well, where you can have negative points that give you more cash back at closing instead of paying fees to lenders.

Origination Charges: This is a fee paid directly to the lender to cover the cost of processing your loan.

Lender Costs: These are costs charged to you buy the lender to get the loan, but are not paid to the lender. They are services the lender requires to get you the loan. Examples include:

- Appraisal Fees

- Tax Service Fees

- Credit Report Fees

- Flood Determination Fees

- Escrow Account Setup Fees (if you will have an escrow or impound account to pay your taxes and insurance)

Title Insurance: All lenders require title insurance to protect the lender. Title insurance companies are typically decided upon in escrow. Buyers typically get title insurance paid for by the seller. These fees can vary based on the title company and escrow company used.

Settlement Services: These are all the other charges required to settle the loan and purchase. They include the lender costs and title insurance, but also include other services that are required to complete your settlement. These can vary by lender and also by location, and they can usually be shopped for, so prices vary. They include:

- Government Recording Charges

- Prepaid Taxes and Insurance

- Daily Interest Charges from Settlement until First Mortgage Bill

- Required Inspections (some lenders and states require pest inspections and/or surveys to be completed prior to close)

Comparing Apples to Apples

Now that you know the terms, you can use this to your advantage when shopping for a loan. As I mentioned above, loan officers and typically sales people trying to get you into a financial product. As such, it is important that you compare every lender using the same metrics. With the recent financial reform legislation, the government has actually improved this process by making a standardize Good Faith Estimate (GFE) form, which all lenders must provide.

When calling lenders and shopping for rates, when you feel like you’ve reached a good settling point, ask them to email you the GFE. If they won’t do it, move on! There is probably something shady in the numbers. Once they do email it, you can start comparing line items.

What To Look For on the GFE

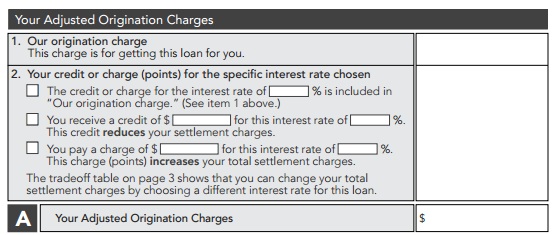

Your GFE is broken into two parts: A (Adjusted Origination Charge) and B (Settlement Services).

A – This is what the lender is giving you for an interest rate, points, and origination fee. This is the biggest box that you want to compare. Ideally, you should NEVER pay an origination charge. There are way too many lenders out there that offer no origination charge, so don’t pay it. Second, I believe that you should avoid paying points as much as possible as well. The only exception is if the seller is crediting you a bunch of money towards closing, and you won’t use it all, use it to buy down your interest rate. Otherwise, don’t pay points out of pocket.

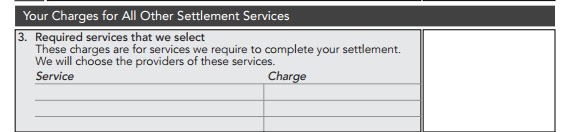

B – In Box B, the only thing that the lender actually controls is what is in #3. Required Services We Select. You should compare the TOTAL of line 3 to the same line on other lender’s GFEs. Some try to charge high amounts for appraisals or other costs to make up expenses in other parts.

Everything else on the GFE, although it could vary from lender to lender, is actually decided by your title and escrow company, and WILL be the same at closing regardless of the lender you choose. As such, you can essentially ignore these lines, or you can get an estimate from your escrow officer and use that estimate to fill in the lines yourself.

Important GFE Facts

- Box A cannot change at closing if you accept your GFE and lock your interest rate before the date and time listed on the front page.

- The Required Services in Box B can only change by 10% if you use the company the lender recommends or identifies. If you select your own company, the rates on the GFE don’t apply.

Getting Lenders to Play Ball

Now that you know how to read the GFE, it’s time to get lenders to play ball and negotiate with you. I use a strategy similar to car buying, in which I contact dozens of lenders, get their phone numbers and email addresses, and get them to send me their best GFEs. Once I find the best one, I email it to all of them asking them to beat it. I can usually do this 2 or 3 times and get my rate down 1/8 to 1/4 percentage, and cut out excess fees.

Once I get to the top 2 or 3 companies, I see who can really throw in a kicker. I ask if they have any incentive programs that could offer cash at closing or free stuff at closing (you’d be surprised what you can get). Remember, these are sales people, so they will usually throw in anything they can to earn your business.

Don’t forget to check local as well. Many credit unions offer great rates, fees, and free stuff that could beat online offers.

Also, you can use a service like Costco Lending, which seeks to compare lenders and give you the top lenders contact information right away in a simple and easy to understand format. Costco puts a lot of stipulations on lenders in its program, and so you can easily compare the lenders it selects. I found that there rates and fees are good, but they are usually just shy of being the best. But you do save hassle by going with them.

My Lender Story

For example, on my current loan purchase, I was able to secure a great interest rate at 3.75% for a 30 year fixed rate loan, that had 0 points and $0 origination fees. The loan had a slightly higher appraisal fee than the next best offer (by only $60), but they lender threw in $2,500 cash at closing.

How was I able to avoid the fees? I got my local credit union to beat the best online pricing at Bankrate. Since they will not sell the loan, they make their money through the interest, not through up-front charges, and so I got a great rate with no crazy fees.

I would say that they required much more documentation than a standard online lender, but they have been very easy to deal with, and the rate and fee structure can’t be beat!

Readers, what advice do you have when it comes to shopping for a loan? Any tricks that have worked for you?

Great story. Will be very helpful for my first time home buying. Although I am trying hard to buy it without mortgage. Let’s see what is in store. May be I will rate shop for a very low mortgage.

This is great. Now that the prices of homes are dropping, I’ve been thinking about purchasing my first house. I’m definitely going to bookmark this and come back to it when it’s time to talk about loans!

Another way to go is to use a mortgage broker to find the best loan for you. However, I still like to understand all the terminology as well. You are lucky to have such low interest rates, here in Australia they are 6 to 7% per year, which is still considered low for us!

There are some good mortgage brokers, but there are a lot who also just charge outrageous fees. Make sure that you are very vigilant if you go this route.

In Australia, most mortgage brokers work free for the borrower as they receive a commission from the bank.

This however, can have ethical implications as you never know if your broker might be biased towards certain loan products due to getting a higher commission.

My first mortgage broker was pretty much useless and I had to chase him up for everthing, but my current broker is awesome and always chases me up.